On 6th March Tom Albanese, the former Rio Tinto CEO, was appointed CEO of Vedanta Resources, replacing M S Mehta. The newspapers are billing his appointment as an attempt to ‘polish the rough edges off [Anil] Agarwal’s Vedanta’ and to save the company from its current crisis of share price slumps, regulatory delays and widespread community resistance to their operations. This article looks at Albanese’s checkered history and the blood remaining on his hands as CEO of Rio Tinto – one of the most infamously abusive mining companies.

The Financial Times notes the importance of his ‘fixer’ role, noting that:

The quietly spoken and affable geologist is seen as someone willing to throw himself into engaging with governments and communities in some of the “difficult” countries where miners increasingly operate. That is something that Vedanta is seen as desperately needing – not least in India itself. Mr Albanese may lack experience in the country but one analyst says that can give him the opportunity to present himself as a clean pair of hands who will run mines to global standards…“There’s a big hill to climb there” Mr Albanese said.(1)

In fact Albanese has already been hard at work for Vedanta since he discreetly joined the company as Chairman of the little known holding company Vedanta Resources Holdings Ltd on Sept 16th 2013, billed as an ‘advisory’ role to Anil Agarwal (Vedanta’s 68% owner and infamously hot headed Chairman)

Vedanta Resources Holdings Ltd (VRH Ltd) (previously Angelrapid Ltd) are a private quoted holding company with $2 billion assets at present, and none at all until 2009. VRH Ltd own significant shares in another company called Konkola Resources Plc – a subsidiary of Konkola Copper Mines (KCM) – Vedanta’s Zambian copper producing unit. This is an example of the complex financial structure of Vedanta – with holding companies like this one serving to move funds, avoid taxation and facilitate pricing scams like ‘transfer mispricing’.

Shortly after becoming CEO of Vedanta Resources Holdings Albanese helped Agarwal by buying 30,500 shares in Vedanta Resources in November 2013 as their share price plummeted and Agarwal himself bought a total of 3.5 million shares to keep the company afloat. In December Albanese bought another 25,163 shares.

By February 2014 he was being sent out to Zambia to manage a crisis over Vedanta’s attempt to fire 2000 workers, which Agarwal himself had failed to fix during an earlier trip in November, and further damage caused by revelations about the company’s tax evasion, externalising of profits and environmental devastation in Foil Vedanta’s report Copper Colonialism: Vedanta KCM and the copper loot of Zambia.

In a taste of things to come newspapers referred to Tom Albanese as the Chairman of Vedanta Resources, and Labour minister Fackson Shamenda alluded to a ‘change of management’ giving them new confidence in Vedanta. Albanese appeared to have done some fine sweet talking, promising that workers would not be fired as part of a ‘new business plan’ and claiming that all of KCMs reports are transparent – an outright lie as their annual reports, profits and accounts are as good as top secret in Zambia and the UK.

However, scandals and unrest continued to blight Vedanta in Zambia and the Financial Times reported that Albanese had flown out a total of four times in February alone.

Albanese’s role as a ‘fixer’ and sweet-talker is nothing new. His appointment as CEO of Rio Tinto in 2006 was on very similar terms, as an article in The Independent newspaper noted his role to ‘green tint’ Rio, and ‘scrub its image clean’. The article mentions that, in an exclusive interview with the paper Albanese declared unprompted that the company is a “good corporate citizen”, and describes him showing no emotion and choosing his words carefully, focusing on safety and environmental and social responsibility.

But Albanese could not play dumb about the reasons a new image was needed for Rio. Since he joined the company in 1993 Rio had been accused and found guilty of a number of major human right violations.

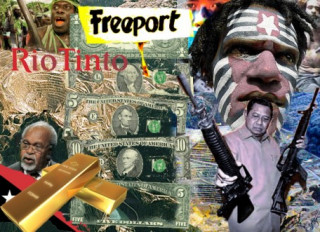

In the early nineties they forcibly displaced thousands of villagers in Indonesia for their Kelian gold mine. They, and partner Freeport McMoran caused ‘massive environmental devastation’ at the Grasberg mine in West Papua, and when people rioted over conditions in 1996, began funding the Indonesian military to protect the mine. $55 million was donated by Freeport McMoran to the Indonesian military and police between 1998 and 2004, resulting in many murders and accusations of torture. In 2010 they locked 570 miners out of their borates mine in California without paycheques leaving them in poverty. In 2008 Rio threatened to shut their Tiwai point aluminium smelter, firing 3,500 if the government imposed carbon taxes. In Wisconsin, Michigan and California the are accused of toxic waste dumping and poisoning of rivers, and in Madagascar and Cameroon they have displaced tens of thousands of people without compensation or customary rights at their QMM mine, and the giant Lom Pangar Dam – built to power an aluminium smelter.

In 2011 a US federal court action accused Rio Tinto of involvement in genocide in Bougainville, Papua New Guinea, where the government allegedly acted under instruction from Rio Tinto in the late eighties and nineties when it killed thousands of local people trying to stop their Panguna copper and gold mine. 10,000 people were eventually killed in the class uprising that resulted from the conflict over the mine. Rio Tinto were accused of providing vehicles and helicopters to transport troops, using chemicals to defoliate the rainforests and dumping toxic waste as well as keeping workers in ‘slave like conditions‘.

Yet, Albanese is being seen as a respectable CEO with a more diplomatic and clean approach than his new Vedanta counterpart Anil Agarwal. There is great irony in Albanese’s promises to improve workers conditions in Zambia when Rio Tinto are famed for their ‘company wide de-unionisation policy’, with 200 people marching against the >ill treatment of mineworkers outside the international Mining Indaba in Cape Town in February, calling them ‘one of the most aggressive anti union companies in the sector’.

Perhaps Albanese will feel at home in another company with a dubious human rights and environmental record. Both Rio and Vedanta have been removed from the Norwegian Government Pension Fund’s Global Investments for ‘severe environmental damages’ and unethical behaviour following investigations. The Norwegian government divested its shares in Rio Tinto in 2008, while it divested from Vedanta Resources in 2007, and also excluded Vedanta’s new major subsidiary Sesa Sterlite from its portfolio just a few weeks ago in January 2014.

Albanese was previously famed for being one of the highest paid CEOs on the FTSE 100, earning £11.6 million in 2011. However he refused his 2012 bonus in a last ditch attempt to save his career at Rio before he was fired in January 2013 amid a total of $14 billion in write-downs caused by his poor decision to acquire Alcan’s aluminium business just before prices crashed, and a $3 billion loss on the Riversdale coal assets he bought in Mozambique, making him in effect a ‘junk’ CEO today.

Other commentators have noted that this is not the first time Vedanta have recruited a junked mining heavyweight to save their bacon, but point out that the appointments have previously been short-lived, possibly due to frustrations about the dominance of majority owner Agarwal and his family. The infamous mining financier Brian Gilbertson, who merged BHP and Billiton, was another scrap heap executive who helped Vedanta launch on the London Stock Exchange in 2003 in the largest initial share flotation that year. However, he quit after only seven months after falling out with Agarwal.

Albanese is diplomatic when faced with questions about potential conflicts between himself and 68% owner and Chairman Anil Agarwal claiming Agarwal “will be in[the] executive chairman role when it comes to M&A and strategy”. However, commentators point out that, ‘the British Financial Services and Markets Act of 2000 stipulated that the posts of CEO and Chairman of companies should be separated – a principle which was backed in October 2013 by the UK’s Financial Conduct Authority’, potentially posing another corporate governance issue for Vedanta, who are already accused of violating governance norms in London by people as unlikely as the former head of the Confederation of British Industry – Richard Lambert.

But Albanese is positive about his re-emergence as a major mining executive. In fact the man with so much blood on his hands may be alluding to his experience in making great profit from others’ misery, when he says to the Financial Times, on the occasion of his appointment as Vedanta CEO, that:

“Sometimes the best opportunities are when the times are darkest”.

1) Financial Times, March 10 2014, ‘Albanese back at the helm to face Vedanta challenge’.

* quotes are only in paper version in section on ‘marriage of convenience between American miner and Indian billionaire.