Aluminium giant Alcoa is one of the most powerful and influential companies in Iceland with it’s poster-child Fjarðaál greenfield1 smelter in Reyðarfjörður, and it’s millions invested in the now failed geothermal smelter project at Bakki, Húsavík. Alcoa’s annual revenue was almost 20 times larger than the Icelandic GDP in 2010 ($21Billion2 versus $1.2 Billion3). Giving it considerable international influence and the potential for frightening leverage in Iceland.They are also becoming one of the biggest lobbyists in Greenland, with eight employees pushing their mega smelter and dam project on this tiny nation.

But who are the faces behind Alcoa? From big pharmaceutical chiefs, to Bilderberg attendees, Iraq profiteers and a Mexican president, Alcoa’s board remains one of the most influential and shadowy of the mining and metals companies. Use the links to Powerbase’s profiles in this article to find out more.

Current Alcoa CEO Klaus Kleinfeld has been an Alcoa board member since 2003. He is also a director of Bayer, the pharmaceuticals and chemical company which grew out of the Nazi company IG Farben, responsible for the medical experiments at Auschwitz. Bayer is now famous for it’s GM and crop science business and was named one of 10 Worst Companies of the Year by Multinational Monitor in 2001. Kleinfeld is associated with all three of the most influential and private ‘global planning groups’. He attended the Bilderberg conference in 2008 and is a member of the Trilateral Commission and Director of the International Business Council of the World Economic Forum. He is also a Director of the Brookings Institution, one of the USA’s biggest think tanks, and the third most cited in Congress.

Kleinfeld was CEO of Siemens from 2005 to 2007 after spending 20 years with the company. He resigned amid a corruption scandal which saw the US Department of Justice investigating the company for charges of using slush funds of €426m (£291m) to obtain foreign contracts, and funding a trade union to counter existing Union action against them. Kleinfeld resigned just hours before the news broke to the media. In 2009, after a lengthy investigation, Kleinfeld and four other executives were forced to pay large compensation sums. Kleinfeld allegedly paid $2 million of the $18 million total collected from the five, though he still denied wrongdoing. Kleinfeld is also on the boards of the finance giant Citigroup and the U.S Chamber of Commerce.

Former Mexican President Ernesto Zedillo has been on Alcoa’s board since 2002, and chairs the Public Issues Committee. Zedillo is a prominent economist and another member of the big three elite think-tanks sitting on the World Economic Forum and the Trilateral Commission with Kleinfeld, and attending the Bilderberg conference in 1999. Like Kleinfeld he is also a director of Citigroup. Zedillo also sits of the International Advisory Board of the Council on Foreign Relations, an American foreign policy think tank based in New York City who carry out closed debates and discussions and publish the journal Foreign Affairs. CFR played a significant part in encouraging the war on Iraq, and helped plan it’s economic and political aims alongside the US Government, particularly how to gain oil contracts after the war. He directs the Club de Madrid, a right-wing/neoliberal focused group of former government officials, think tankers and journalists involved in pushing reactionary policies to terrorism (referring to the Madrid bombings).

Mr. Zedillo was Mexican president from 1994-2000. He was appointed by Secretary General Kofi Annan to be the United Nations Special Envoy for the 2005 World Summit, and chaired the World Bank’s High Level Commission on Modernization of World Bank Group Governance in 2008. He is a director of JPMorgan-Chase, Proctor and Gamble, BP, Rolls Royce and an advisor to the Bill & Melinda Gates Foundation. He directs the Center for the Study of Globalization at Yale University, which puts out influential reports and papers edited by him.

A fellow member of the Council on Foreign Relations is Alcoa board member E.Stanley O’Neal. O’Neal is a Harvard graduate and investment banker who served as CEO of Merrill Lynch from 2002 to 2007 and is a director of the New York Stock Exchange (now NYSE Euronext), the Nasdaq Stock Market and BlackRock – a key investor in the mining and metals industry. According to Forbes he was awarded $22.41 million in 2006. Mr O’Neal is also a trustee of another shady organisation, the Center for Strategic and International Studies, a private group led by John J. Hamre, former deputy secretary of defence which ‘provides world leaders with strategic insights on — and policy solutions to — current and emerging global issues’. CSIS provided propaganda materials used by the CIA to destabilise the Government of Chile in the run up to the 1973 coup.

A third Council on Foreign Relations member sits on Alcoa’s board. James W. Owens is Chairman of the Business Council of the CFR, CEO and Executive Chairman of Caterpillar from 2004 to 2010 and Alcoa board member since 2005. Caterpillar are famous for their tendency to profit from war-induced contracts including in Israel and Iraq, just the sort of thing that the Council on Foreign Relations are interested in. Owens is also a director of the International Business Machines Corporation and Morgan Stanley and a senior advisor to Kohlberg Kravis Roberts & Co, a global asset manager working in private equity and fixed income.

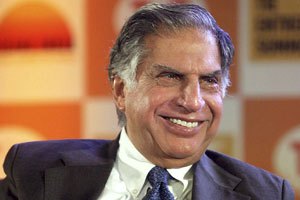

Indian mega magnate Ratan Tata has been a director of Alcoa since 2007 and is currently a member of the International Committee and Public Issues Committee. He chairs Tata Sons, holding company for the Tata Group, the family business which is one of India’s largest business conglomerates including telecoms, transport, tea and now one of the biggest steel companies in the world after they bought Corus outright in 2007. As well as his directorships of most of the Tata companies, he is also a a former director of the Reserve Bank of India, and advisor to NYSE Euronext (the New York Stock Exchange), and JP Morgan – one of the largest shareholders of the London Metal Exchange who set metal prices worldwide and enable banks to stockpile and futures trade aluminium. Mr Tata is also trustee of Cornell, Southern California, Ohio State, and Warwick Universities, a director of the Ford Foundation and a member of the UK Prime Minister’s Business Council for Britain.

A fellow member of the Ford Foundation, and Saving Iceland favourite most-wanted, is Kathryn Fuller. Ms Fuller chaired the Ford Foundation from 2004 to 2010 and has been a trustee since 1994. However she is most famed for her contradictory positions as World Wildlife Fund (WWF) Chief Executive (1989-2005) and Alcoa board member (since 2001). Newspaper Independent on Sunday claimed she joined Alcoa in exchange for a $1m donation to WWF US and allowed Alcoa to join WWF’s exclusive “Corporate Club”, a claim Fuller has found hard to refute. Despite publicly opposing the highly controversial Fjarðaál smelter project, Fuller abstained rather than voting against the project in Alcoa’s boardroom. Elsewhere she has claimed that Alcoa holds “a strong commitment to sustainability, including energy efficiency, recycling, and habitat protection.”

Compared to these heavyweights Alcoa’s other current board members may look like small fry, but they still command an impressive and worrying influence across a number of boards.

Sir Martin Sorrell is founder and chief executive officer of the £7.5 billion communications and advertising company WPP. He has been a NASDAQ director since 2001 and was appointed an Ambassador for British Business by the Foreign and Commonwealth Office. Before founding WPP, Martin Sorrell led the international expansion of famed UK advertising agency Saatchi and Saatchi. He calls himself ‘a money man’ saying: “I like counting beans very much indeed”.

Arthur D. Collins, Jr. is a big pharmaceuticals boss. He is retired Chairman and Chief Executive Officer of Medtronic Inc. who he had been with between 1992 and 2008, and previously Corporate Vice President of Abbott Laboratories from 1989 to 1992. He also sits on the boards of arms manufacturers – Boeing, and bio-tech giant Cargill.

Michael G. Morris has been Chairman, President and Chief Executive Officer of all major subsidiaries of American Electric Power since January 2004 having been a company executive since 2003. He is also a Director of the USA’s Nuclear Power Operations and the Business Roundtable (chairing the Business Roundtable’s Energy Task Force) as well as the Hartford Financial Services Group. He was listed 158th on the Forbes Executive Pay list in 2011 and received a total $9 million in 2010.

Finally, Patricia F. Russo, is a Director of asset management group KKR & Co, General Motors, Hewlett Packard and drug manufacturers Merck & Co, who’s arthritis treatment Vioxx induced heart attacks and sudden cardiac deaths in 27,000 people between 1999 and 2004. Merck were exposed for trying to bury negative evidence and distort drug trials to hide the known cardiovascular effects of Vioxx. Litigation following the scandal is ongoing and will be part of the business of Ms Russo.

Coming back to Iceland there is another former director of note. Norwegian national Bernt Reitan was Alcoa Executive Vice President from 2004 to 2010 and a director of iron alloy and silicon company Elkem from 1988 to 2000, putting him in the centre of the development of Iceland’s Hvalfjörður Elkem plant, and the Fjarðaál aluminium smelter. Elkem subsidiary Elkem Aluminium was sold to Alcoa in 2009. Reitan broke the ground at the massive Fjarðaál smelter in Reyðarfjörður in 2004 alongside Valgerður Sverrisdóttir, then Minister of Industry, and Guðmundur Bjarnason, Mayor of Fjarðabyggð. In view of his influential position in Iceland Reitan sits on the Icelandic-American Chamber of Commerce which was formed by the Iceland Foreign Trade Service in New York and promotes trade between Iceland and the USA.

Mr Reitan is also a Director of the International Primary Aluminium Institute and a former board member of the European Aluminium Association as well as Royal Caribbean Cruises Ltd, Yara Internation ASA and Renewable Energy Corporation ASA.

The combined power of these Alcoa Directors reaches deep into the political and corporate structures of the USA and Europe. In this light it is a mean feat for Alcoa to be ejected from Húsavík, but we can be assured that Alcoa’s aluminium claws are still dug in deep in Iceland – a small country with such cheap and abundant hydro power.

________________________________________________________

For more information on Powerbase’s mining and metals research please visit the Mining and Metals portal and peruse the aluminium industry profiles.

See other key figures in Iceland’s heavy industrialisation at our Hall of Shame.

Notes and References:

[1] The terms “greenfield” and “brownfield” are used by the aluminium industry, and though the former might give an image of a “green” and less environmentally damaging construction than the latter, the meaning is in fact the absolute opposite. Samarendra Das and Felix Padel explain the difference: “While a brownfield project renovates or adds to an existing plant […] “greenfield” has a more attractive ring to it, but what it means is turning an area of green fields and forest brown as the area is cleared and polluted…” See: Samarendra Das and Felix Padel. 2010. Out Of This Earth – East India Adivasis and the Aluminium Cartel. Orient Black Swan. India. p. 336.

[2] Esmarie Swanepoel, 11 Jan 2011 ‘Alcoa Posts $21bn revenue in 2010’. Mining Weekly. Accessed 22/02/2012.

[3] Icelandic-American Chamber of Commerce, Statistics. Accessed 22/02/2012.

See also:

From Siberia to Iceland: Century Aluminum, Glencore and the Incestuous World of Mining – A special report for Saving Iceland by Dónal O’Driscoll, about the people and crimes behind Glencore International and Century Aluminum, which runs the Hvalfjörður smelter mentioned in the article above and fantasize about operating another one in Helguvík.

January 9th 2014:

“The Securities and Exchange Commission and Department of Justice unveiled civil and criminal charges against aluminum producer Alcoa Inc. today, charging that the company made more than $110 million in corrupt payments to Bahraini officials to procure a contract with a state-owned Bahraini aluminum company. Alcoa has agreed to settle the SEC and DOJ actions by paying a total fine of $384 million.”

More info here.

Additional information: Since November 2013, Icelander Tómas Már Sigurðsson — current President of Alcoa European Region and Alcoa Global Primary Products Europe, and former Managing Director of Alcoa Fjardaál — has been in charge of Alcoa in the Middle East. Asked about the bribery charges by Icelandic newspaper DV today, Sigurðsson declined to comment on it.