Jul 06 2008

Iceland Overheats

Icelandic Economy Suffers as Century Shareholders Make Record Profit

By Jaap Krater

As inflation rates in Iceland soared to 8.7% and the Icelandic krona lost a third of it’s value, US-based Century Aluminum started construction of a much disputed aluminium smelter at Helguvik, southwest of the capital Reykjavik. The Icelandic economy is suffering from overheating as billions are spent on construction of new power plants and heavy industry projects. The central bank raised the overnight interest rate to a whopping 15% to control further price increases as Icelanders see their money’s value disappearing like snow. It would seem that the last thing the tiny Icelandic economy needs is further capital injections.

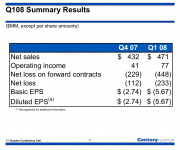

But Icelandic investors are making record profits from the new projects. The value of shares sold to them by Century less than a year ago to finance the Helguvik smelter has increased by 33%, though the company has not made a profit in years. Read More